National policy and practice tend to focus efforts and resources on disaster response and recovery, rather than on disaster risk reduction. Understanding disaster risks and incentivizing sustainable risk reduction efforts could help reduce overall disaster costs and even save lives.

Disasters are about lives. Those lost. Those put on hold. Those scattered to pieces. All of these lives should be at the center of policy discussions. Although the effect of disasters is difficult to witness, their impact is easily noticeable. Readily found online among the thousands of images of people, property, livelihoods, dreams, and a collective sense of security buried under rubble, torn apart, washed downstream, or blown away by disasters are also scenes of rescue, bravery, rebuilding, and recovery. Evidenced by the recent events in West Virginia, Texas, and Florida, the United States has a remarkable capacity for responding to disasters. Watching communities come together in the aftermath of tragic events to support one another – with examples like Joplin, Missouri’s resilience efforts after the 2011 tornado destruction and “Boston Strong” following the 2013 bombings – the capacity for recovery and rebuilding is clear. Yet, with nearly as many deaths from billion-dollar disasters as from U.S. military fatalities in the Iraq and Afghanistan Wars (6,756) and domestic terror attacks (3,158) combined, the capacity for disaster risk reduction is not as apparent.

In light of the almost 9,500 deaths that have occurred just in disasters costing a billion dollars or more in damage since 1980, there is no need to wait for something terrible to happen. Mark Keim, founder of DisasterDoc LLC and a disaster medicine expert, has remarked that the goal should be to save every single life from natural disasters. Some would even say that there is no such thing as a “natural” disaster and many of the associated deaths and damage costs are not inevitable. Perhaps holistic approaches could manage the causal factors of disasters, reduce exposure to hazards, lessen vulnerabilities of people and property, and better manage the land and environment – overall improving preparedness for adverse events. Perhaps social impact bonds – an emerging “pay for success” financing model for programs with social benefits – could be used to fund approaches that could save lives and decrease the economic damage of disasters. Perhaps public health could be the connective tissue across it all, because the profession is already experienced with these approaches. These concepts may be too good to be true, but they are certainly worth consideration.

The Nature of Disasters & Risk

Natural hazards and resulting disasters are not a new phenomenon, but they are becoming more frequent and increasingly severe, continuing to result in loss of human life and significant economic damage. According to the National Centers for Environmental Information, from 1980 to 2014, the United States experienced 178 disasters with damage of $1 billion or more per event, with an average of about five events per year. Between 2009 and 2014 alone, there were 56 disasters costing more than $1 billion each, with an average of nine events per year. These hazards are almost impossible to prevent, but the destruction that occurs – often perceived as inevitable and expected – can be.

A state of disaster only occurs when the hazard exceeds the coping capacity (i.e., the ability of people, organizations, and systems using available skills and resources to face and manage adverse conditions, emergencies, or disasters) of an individual or community. Three feet of snow in Buffalo, New York, is just another Tuesday in January for them. But even the prediction of one foot of snow in the nation’s capital would cause a total shutdown, complete with terms like “snowpacolypse” and “snowmageddon” and disappearance of all bread products from grocery stores. Although the result is relative, it is not mysterious. Knowing how to determine risk means that it should be possible to reduce the occurrence of disasters.

To determine an individual’s or community’s level of risk for disaster (i.e., potential loss of lives, health, livelihood, assets, services, infrastructure), three factors collectively determine disaster risk:

- Vulnerability – the physical, social, economic, and environmental circumstances that make it susceptible to the damaging effects of a hazard;

- Coping capacity – the ability to use existing assets to manage adversity; and

- Specific hazard exposure – the characteristics of the phenomenon, substance, human activity, or condition that may cause loss of life, injury or other health impacts, property damage, loss of livelihoods and services, social and economic disruption, or environmental damage.

Examining these factors, disaster risk can be reduced by decreasing a community’s vulnerabilities, mitigating its exposure to hazards, or increasing its coping capacity through building resilience. Collectively, this approach is known as disaster risk reduction (DRR). Globally, this concept has taken root. The signing of the Sendai Framework for Disaster Risk Reduction 2015-2030 (Sendai Framework) – a 15-year voluntary, nonbinding agreement that maps a broad, people-centered approach to disaster risk reduction – renewed an international commitment from 2005 and focuses on holistic approaches to DRR, now with health included.

However, U.S. disaster policy still lags, with response and recovery efforts after a disaster largely the focus. In addition to the need for response and recovery is the need to consider community vulnerabilities and assets in developing “upstream” policy, systems, and environmental interventions to reduce disaster risk. This risk reduction perspective is common in domestic public health strategies, which positions the profession well for rethinking how to approach disasters and shift some of the focus to before a disaster.

Public Health Approaches

The aim of public health is for every person to have a chance at a secure, productive, and healthy life. A large part of this involves reducing or eliminating mortality and morbidity associated with a host of “hazards,” which include chronic disease, community violence, or even car crashes. Public health approaches most hazards with consideration of exposure and behavior, underlying vulnerabilities, and a capacity to cope or bounce back. This same approach should be taken with disasters.

For the most part, though, U.S. public health preparedness and emergency management practitioners have largely focused on the acute response immediately following a disaster and in helping those that survive. Yet, most disaster-related deaths occur during the impact, before response teams can even deploy. These deaths do not need to be accepted as inevitable. With prevention as a key aspect, public health’s goal should be to think more creatively about how to stop these deaths from occurring at all. Of course, how to pay for this is the next question. The answer gets a bit complicated and, like many things, politics and power influence the options. It is important, however, to understand the context these forces create before looking for the “how.”

Policy, Spending, & (Dis)Incentives

U.S. national disaster policies, incentives, and financing tend to be reactive, focused heavily on response and recovery actions following disasters. Although private commercial, insurance, and reinsurance entities certainly share the burden of disaster costs, the cost for response and recovery has fallen increasingly on government, and thus the public. And the public, with perhaps a psychologically rooted inclination to not see the worst-case scenario, tend to support elected officials in this behavior, even though investing in prevention and preparedness has been shown to produce large social and cost-effective benefits. Numerous studies estimate that, for every $1 spent in preparedness activities, as much as $15 in disaster damage is prevented.

Making matters worse, local, state, and volunteer organizations often encounter gaps in financial resources for disaster response and recovery. This can lead to delayed reconstruction, eventually shifting development trajectories and hampering long-term economic growth. The Stafford Disaster Relief and Emergency Assistance Act gives the federal government the authority to supplement the efforts and available resources of state and local governments to respond to and recover from disasters, even though the federal government is not meant to be the first-line provider of emergency assistance and disaster response and recovery. The federal government will provide assistance, though, when the disaster exceeds the coping capacity of state and local governments, but often at a very high cost.

It could be far less costly to invest in disaster risk reduction measures. However, politically speaking – and aside from the inherent partisanship – it is easier for all levels of government to appropriate and spend money reactively, only after a disaster and when the damage and need is visible. Since predicting natural hazards and forecasting disasters remains extremely difficult and imprecise, politicians often do not risk investing in strategies to mitigate disasters that might not occur because their constituents tend to see this spending as a waste – especially when the strategies are not evidence-based.

This is also a common problem for public health. Often, successes are the absence of adverse outcomes and thus difficult to visualize. This lack of a tangible, and marketable, success presents a strong disincentive for risk reduction practices. Additionally, tacking on another separately funded program to already burdened public health and emergency management offices throughout the country is not practical given existing competition for scarce resources.

Rather than continuing on this reactive, politically motivated, response-based course, the national disaster approach must be reformed to sustainably fund pre-disaster planning and DRR programs. Alternative financing programs aimed at preventative and risk reduction measures, which are not a condition of political will and voter support, are needed. One way to do this is to incentivize private investors to generate alternative financing and shift the burden away from the public sector and shortsighted political will.

Financing Disaster Risk Reduction & Preparedness

A type of alternative financing is social impact bonds (SIBs), which are already gaining traction both internationally and domestically for other types of programs. SIBs are a type of pay-for-success (PFS) financing mechanism used to raise upfront funding for social and public interventions from philanthropic and private investors. Payers – typically governments – leverage the anticipated savings due to prevention of an adverse outcome as a source of financial rewards for the investors. Rewards are due if and only if the intervention succeeds in reaching predetermined benchmarks, thereby shifting the financial burden of success to investors.

If successful, SIB programs have a policy trifecta benefit: the government saves money; the private sector makes money; and populations (often vulnerable ones) have better outcomes and services. Not surprisingly, lawmakers are increasingly interested in SIBs. As of 2015, nine states had laws relating to PFS or SIB programs and 19 states have PFS or SIB laws. The 113th and 114th Congresses saw numerous bipartisan PFS legislations proposed, and $300 million was allotted for PFS in the president’s FY2016 budget proposal.

SIBs can be and are already used to fund complicated programs throughout the United States and abroad, such as the California Endowment’s SIB program to fund delivery of outcome-based social services in the areas of juvenile restorative justice and foster care, as well as other programs aimed at improving homelessness, juvenile recidivism, asthma, diabetes, and elderly service outcomes. SIBs are also being considered a viable option for financing global pandemic preparedness. During the Global Health Risk Framework: Pandemic Financing workshop convened by the National Academies in 2015, Adam Bornstein of the Global Fund said that “private-sector investors are happy when their money goes out and is put to work.” He further stated that, “as long as they are compensated for the lending, the rate of return need not be particularly high. Provided there are course-correction measures in place to ensure the money is being spent properly and efficiently, finding investors should not be difficult.”

SIBs could possibly be used for funding disaster prevention and risk reduction programs. A SIB creates a mutually beneficial alliance between private and public sectors, something that has often escaped in preparedness planning, and could create a strong political incentive for support and action. An inherent strength of the private sector is to identify and employ successful and cost-effective services and products – as their financial profit motive incentivizes such behavior. Alternatively, the public sector is incentivized by a social profit motive, but is not always successful in using evidence-based and cost-effective approaches. SIBs have been demonstrated to align these respective motives to solve complicated social problems, while leveraging strengths and mitigating weaknesses within the sectors. Because of this, SIBs could be effective for financing disaster risk reduction and preparedness and should be explored further. An obvious argument against private sector investment might be the sentiment that no one should profit from disasters. In this case, though, the private sector would actually be profiting from the opposite, a reduction in disaster losses – a worthwhile endeavor by most accounts.

How SIBs for DRR Might Work

Use of SIBs to support disaster risk reduction programs requires three important design conditions, as noted in a related 2013 white paper on alternative financing mechanisms commissioned by the National Academies’ Forum on Medical and Public Health Preparedness for Catastrophic Events. First, there must be evidence that the proposed interventions are effective at producing the desired outcome. Second, there must be an accurate assessment of potential loss. Third, public attitude – and the accompanying political will it often engenders – needs to support risk reduction rather than reactive approaches to disasters.

Meeting these conditions might present the greatest barriers to implementing SIBs for disaster risk reduction. Unfortunately, there is little empirical work in understanding how risk reduction investments affect an individual’s or a community’s overall vulnerability and coping capacity. Without this data, it can be difficult to measure success. Much of the investments into preparedness by the government and public sector over the past few decades have not been toward evidence-based programs. Therefore, it is necessary to pilot test and assess the successfulness of interventions before there can be wide-scale implementation through SIB investment.

SIB investment would primarily make sense in areas with a history of disasters because more-predictable assessments of expected losses would be possible. In the private insurance markets, estimates of expected losses/costs are routinely used to determine insurance premiums to cover against many sources of accident or injury. In short, it is easier to determine how much was saved during a performance period through intervention programs because data on many past events and corresponding losses can be examined.

Public attitude can sway political behavior. Ideally, people and policy makers would focus on DRR, supporting systemic, evidence-based interventions. In reality, people tend to focus on risks that are immediate or memorable and that incentivizes politicians to support funding reactive interventions. Funding SIBs would require support of a paradigm shift by practitioners, policy makers, and the public. Without this support, SIBs for disaster risk reduction are very unlikely.

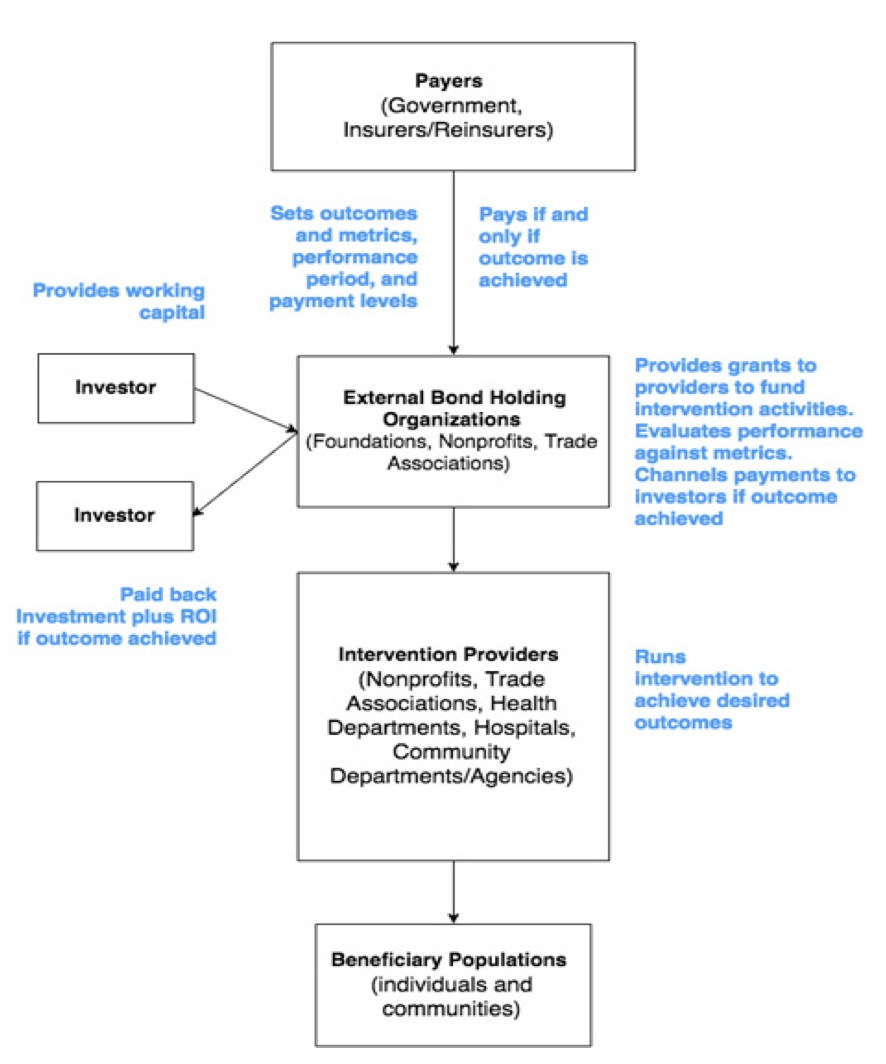

With these three conditions in mind, the applicability of SIBs can be explored through a hypothetical scenario using 2009-2014 U.S. disaster loss cost data, which totaled about $148 billion. Following the framework in Figure 1, in early 2000, payers (government, insurers, and reinsurers) would establish the desired outcomes and success metrics. Since it is not likely that a total elimination of disasters and related losses is possible, this scenario assumes that the desired outcome would be a 20-percent reduction in the costs from disaster losses – a reduction of about $30 billion. Next, payers would seek investors such as the private sector and banks to front about $2 billion (one-fifteenth of the anticipated savings). A return on investment (ROI) would be set – this example assumes 5 percent, but it could be higher or lower depending on the negotiated payout rate.

Once an investment agreement is settled, private funding would be channeled to an external bond holding organization (e.g., foundations, nonprofits, trade associations) that would issue the bonds and administer a grant process to service providers (e.g., local and state government, nonprofits, health departments, hospitals, community organizations). Service providers would use these grants to implement evidence-based risk reduction and intervention programs aimed at the aforementioned risk factors in areas of the country with predictable disaster risk and known history damage losses and costs. Intervention programs would be measured for success at reducing the cost, damage, or losses associated with disasters over the performance period, which in this scenario is 2009-2014.

If success were found, the payers would channel a portion of their savings to the external organization for payment to the investors. In this scenario, investors would receive the initial amount of $2 billion plus $100 million in ROI if successful. If an intervention were not successful – for example, disaster-related losses were typical or increased during the performance period – the investor would not be reimbursed or gain a ROI. As such, the payers could have saved $27.9 billion. This example is an oversimplification, and investment amounts can be much lower or even higher, but it illustrates the possibility of savings for payers, incentives for investors, and benefits for individuals and communities.

A Future of Sustainable Disaster Risk Reduction

Given the growing detriment of climate change, social and structural inequities, population density, and aging infrastructure in hazard-prone areas, communities cannot continue to merely react to disasters. There must always be a capacity to respond to disaster, but there should also be a focus on reducing risk and preventing disaster. SIB models offer an alternative financing solution for an already stressed and under-resourced public system. However, even with three well-defined conditions, changing “the way we do business” is no easy task.

There are, however, viable lessons from the international community on DRR strategies, and a growing commitment from the U.S. government and other domestic partners to implement the Sendai Framework over the next 15 years. The public health sector should capitalize on these opportunities to investigate potential evidence-based strategies, educate policymakers and their constituents about the benefits of proactive, risk-reducing approaches, and perhaps even sway their behavior and affect necessary change. In doing so, communities could save money, avoid devastating damage, and maybe even prevent deaths.

The authors are responsible for the content of this article, which does not necessarily represent the views of the National Academies of Sciences, Engineering, and Medicine.

Justin Snair

Justin Snair, M.P.A., CBCP, is the founder and principal consultant with SGNL Health Security Solutions and co-founder of Naseku Goods. Formerly, he was a senior program officer with the National Academy of Sciences, Engineering, and Medicine and directed the Forum on Medical and Public Health Preparedness for Disasters and Emergencies and the Standing Committee on Medical and Public Health Research During Large-Scale Emergency Events. In 2012-2015, he served as a senior program analyst for critical infrastructure and environmental security at the National Association of County and City Health Officials. For six years, he was the local preparedness director and environmental health agent with the Acton Public Health Department in Massachusetts. In 2001-2006, he served as a corporal and combat engineer in the U.S. Marine Corps Reserves and is a veteran of the Iraq war. He holds a Master of Public Administration degree from Northeastern University’s School of Public Policy and Urban Affairs, a Bachelor of Science degree in Health Science from Worcester State University, and is an executive fellow with Harvard University’s National Preparedness Leadership Initiative.

- Justin Snairhttps://domesticpreparedness.com/author/justin-snair

- Justin Snairhttps://domesticpreparedness.com/author/justin-snair

- Justin Snairhttps://domesticpreparedness.com/author/justin-snair

- Justin Snairhttps://domesticpreparedness.com/author/justin-snair

Megan Reeve Snair

Megan Reeve Snair, M.P.H., is a program officer with the Board on Global Health at the National Academies of Sciences, Engineering, and Medicine. Previously with the Board on Health Sciences Policy, she worked primarily on projects and studies related to medical and public health preparedness, global health security, and community resilience. Before joining the National Academies, she worked as an emergency planner for local health departments in Massachusetts, focusing on all-hazards preparedness and the Medical Reserve Corps program. She also spent time with the Boston Public School district analyzing data to improve health services and identify gaps in student health and wellness in an urban environment. She received her Master of Public Health degree from Boston University concentrating in epidemiology and holds a Bachelor of Science degree in biophysics from St. Lawrence University in New York.

- This author does not have any more posts.